What is Open Data?

There are two popular uses for this phrase:

Open data - information that is linked and publically accessible via the web.

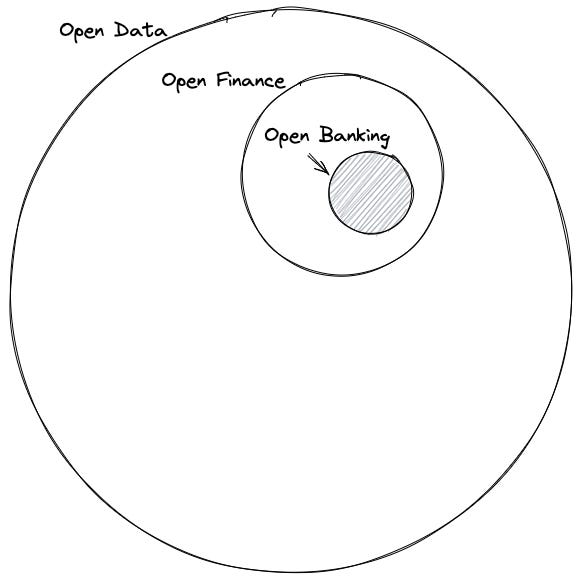

Open Data - a superset of Open Banking and Open Finance.

This article focuses on the latter, Open Data, which feels like a slight misnomer. But, the ODI has written about the connection between them so we’ll roll with it.

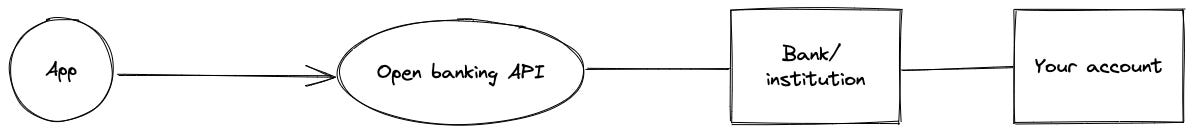

First came Open Banking, turning banks (and other financial institutions) into technology companies. Apps can now securely connect to bank accounts, offering a lot of benefits.

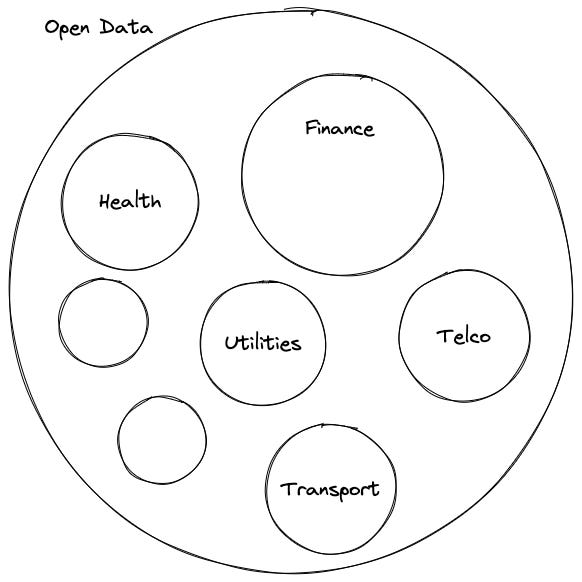

But it doesn’t stop there. Open Banking is considered just a subset of Open Finance, which allows apps to access other products like investments, insurance, mortgages and pensions. And Open Finance turns out to be a subset of Open Data, suggesting an even wider range of services that could be unlocked through open APIs.

Today, Open Banking is the most widely deployed version of Open Data, but other potential candidates for the ‘Open’ treatment are actively being explored, including health, utilities and telco. Open Health is even reported to be in early-stage usage.

In a fast-changing world, institutions (critical infrastructure providers) use technology to reduce costs and increase efficiencies. It’s no secret that the cloud is a big part of that. Today, 94% of enterprises have at least some infrastructure in the cloud.

With cloud vendors like AWS, GCP and Azure offering bespoke API solutions targeted at enterprises, we can expect institutions to more easily launch APIs that have strict policies and granular access control.

Open Banking architecture guidance is already provided by AWS and GCP, supported by a range of technology companies offering complimentary on-premises, cloud and hybrid solutions.

What could go wrong? 🫣

Too much too soon

Open Banking is arguably still unproven. The APIs seem to mature slowly. In the UK, often considered the most mature market, the Open Banking Implementation Entity reports average availability of less than 99.9%. Metrics from other countries are limited, but the numbers are likely even lower. Highly available and performant APIs are necessary for a good customer experience and would better encourage future efforts in other sectors.

Misaligned incentives

The Shirky principle:

Institutions will try to preserve the problem to which they are the solution.

Institutions that don’t operate in a world of cloud and SaaS sometimes don’t see an immediate benefit to offering open APIs. Though most Open Banking providers are embracing the opportunity, some are still focused on short-term gains, especially in markets where the ecosystem is still very nascent. As the OpenID Foundation’s white paper points out, regulations can help to spark changes in institutions’ business practices.

Data safety

People are only willing to share data when the benefit of the service outweighs the risks of compromised data. Communicating and ensuring data safety is critical to Open Data’s success. But unfortunately, it only takes one institution, or even worse, an intermediary service, to lose the trust of a significant portion of people.

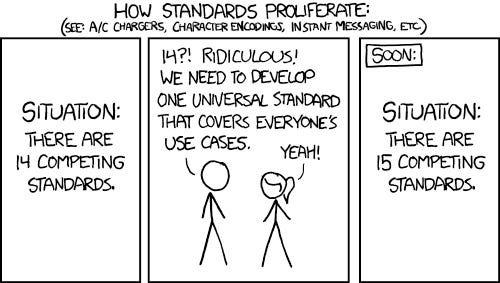

Fragmentation

It surprises many people that Open Banking means different things between nations. Banks often create proprietary APIs too, making integrations painful and data differences irreconcilable.

Nowadays, people expect interoperability as a given. However, the slow progress of a fragmented system could see people abandon Open initiatives for alternative technologies like crypto and Interledger.

What could go right? 👌

Customer experience

There’s a crazy amount of room for innovation in finance. Embedded experiences bring products to wherever their customers are, whether a retail store, car or the metaverse.

When an app’s call-to-action to takes a customer to their banking app, they invariably experience higher conversion rates than ‘out of band’ journeys. People no longer need to print statements or copy and paste account numbers. There’s also less form filling and the potential for typos.

Efficiencies

People can save time on various admin tasks, including form filling, whether using new apps or old ones.

One of my favourite examples of Open Banking is accounting software. Businesses connect their bank accounts and categorise transactions in-app. Just a few years ago, people would have had to manually do the same using their statements, going back and forth with their accountants.

Data ownership

An Open Data economy would let customers take their data wherever they want, allowing them to access better value services. This gives people more control and lowers the barrier to understanding their entire situation. For example, you can imagine effortlessly moving medical records to a new provider or having a comprehensive dashboard for all of your finances.

Data safety

Companies that connected to bank accounts before Open Banking used less reliable, less secure methods. By creating dedicated interfaces, we can ensure that systems adequately protect data security and privacy.

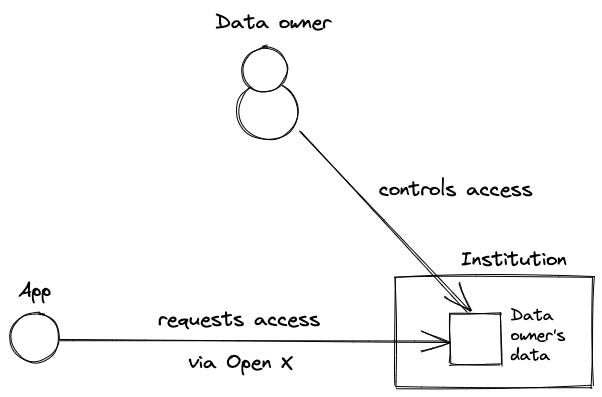

When customers opt-in to Open Data, they are deciding to allow a specific company to perform a specific action with their data.

This gives governments and regulators a way to provide transparency about data protection to their citizens. In an ideal world, it could put an end to any justification for the trading of personal data without owners’ consent.

Final thoughts

Nobody knows what the future holds, but I’m interested in how the Open Data ecosystem evolves. It could still fail, but I think it has a good chance of succeeding.

Open Finance has already generated a lot of interest from governments and industry players across the globe. Today, customers expect Open Banking features in their apps but are also concerned about data safety. So I believe we’ll need to focus on inclusion and data safety to make Open Data a reality.